June 2016

While credit risk exposure has traditionally been captured by spreading over-the-counter (OTC) interest rate swaps (IRS) against on-the-run (OTR) U.S. Treasury notes or bonds, the expansion of Exchange listed US Dollar Interest Rate Swap futures (deliverable swap futures, or DSFs) at the major tenor points of the Treasury yield curve (2-,5-,7-,10-,20-,30-Years) has created new opportunities for market participants to futurize credit risk spreads. Among potentially many applications, when they are used in conjunction with Treasury Note futures or Treasury bond futures, DSFs provide an alternative, capital-efficient means to acquire or to hedge swap spread exposures. Following a brief overview of DSFs, Treasury futures, and Swap Spreads, this note illustrates how.

DSF Overview

DSFs are contracts for physical delivery of plain-vanilla interest rate swaps (IRS) cleared and guaranteed by CME Clearing. Each contract is for $100,000 notional principal of its deliverable-grade IRS. When a DSF for a given delivery month is initially listed for trading, the Exchange assigns a standardizing fixed rate for its delivery-eligible IRS (eg, 0.50%, 0.75%, 1.00%), typically aligned with the corresponding Market Agreed Coupon (MAC) IRS rate recommended by the SIFMA Asset Management Group. (For more about MAC IRS, please visit http://www.sifma.org/services/standard-forms-anddocumentation/swaps/.) Accordingly, any DSF’s deliverable-grade IRS has an effective date equal to the third Wednesday (ie, IMM Wednesday) of the DSF contract’s delivery month, and pays semiannual fixed interest at its assigned standardized fixed rate per annum in exchange for quarterly payments of floating interest equal to three-month ICE LIBOR. For more about the structure of DSF contracts, please visit http://www.cmegroup.com/trading/interest-rates/deliverable-swaps.html.

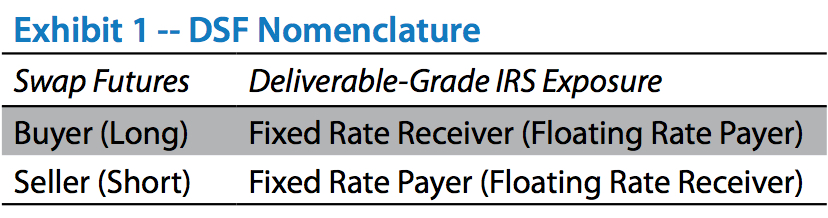

The buyer of a DSF who takes contract to delivery becomes the receiver of fixed interest (payer of floating) in the delivered IRS. Conversely, upon delivery the holder of short position in a DSF becomes the receiver of floating interest (payer of fixed) in the delivered IRS.

A DSF contract’s price is quoted as 100 points of par (equal to $1,000 per price point) plus the net present value (NPV) of its deliverable-grade IRS. NPV is equal to the present discounted value of the IRS’s fixed rate payments minus the present discounted projected value of its floating rate payments —

NPV = PV(Fixed rate) – PV(Floating rate)

The NPV is then converted to contract price points and 32nds of price points and added to 100. Because NPV may be either negative or positive, depending on the projected value of floating rate payments relative to fixed rate payments, DSF contract prices may be quoted either above or below par. In the hypothetical examples below, NPV is either $33 or -$33 per DSF contract. With each 32nd of a contract price point equal to $31.25 (or $1000 per point / 32), the absolute magnitude of NPV in each case is 1.056 / 32nds. Given that contract minimum price increment is set to ½ of 1/32nd (equal to $15.625 per contract) for 7-Year DSF and 1/32nd for 20-YearDSF, NPV in these cases would be apt to be quoted at the nearest 32nd (Exhibit 2).

Treasury Futures Overview

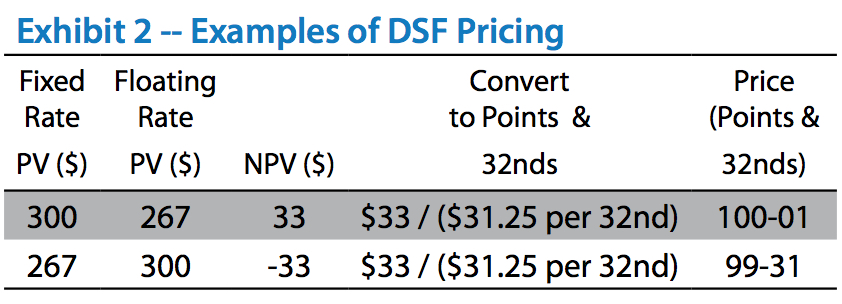

Treasury Futures are among the most highly traded of all futures products. Futures delivery months are March, June, September, or December. Each contract is fulfilled by delivery of $100,000 ($200,000 for 2-Year U.S. Treasury Note futures) face value of Treasury notes with various remaining term to maturity (RTM) from the first day of its delivery month, as shown in Exhibit 3.

All Treasury Note and Bond futures rely upon a system of delivery invoice conversion factors standardized to a notional yield of 6% per annum. When prevailing market yields are above 6%, consequently, the Treasury issue that is cheapest to deliver (CTD) into an expiring futures contract tends to be the member of the deliverable grade with longest Macauley duration. Conversely, when market yields are below 6%, as at present, the deliverable-grade security with shortest duration tends to be CTD into its corresponding expiring futures contract.

For more about Treasury futures, please visit http://www.cmegroup.com/trading/interest-rates/

Swap Spread Overview

The credit spread between private and public credit risk– represented respectively by the credit risk of banks and the U.S. Treasury — is a market that has traditionally been captured by spreading over–the-counter (OTC) IRS against the on-the-run (most recently issued) cash U.S. Treasury notes and bonds. The swap spread at each tenor is equal to the spot starting swap rate less the yield of an on-the-run U.S. Treasury note of comparable maturity. Typically, a swap spread trade encapsulates an outlook on the expectation of improvement or deterioration in the public and private credit markets, depending on the position of the market participant.

As changes in market structures and banking regulations increase demand for off-balance sheet exposure, liquidity in Treasury futures has grown significantly, rising to levels comparable to cash Treasuries markets. Increasing futures liquidity, coupled with the close relationship between the cash swap spread (OTC IRS rate – OTR Treasury yield) and futurized swap spread (DSF – Treasury Future), allows market participants the opportunity to capture cash swap spread exposure by spreading similar DSF and Treasury futures.

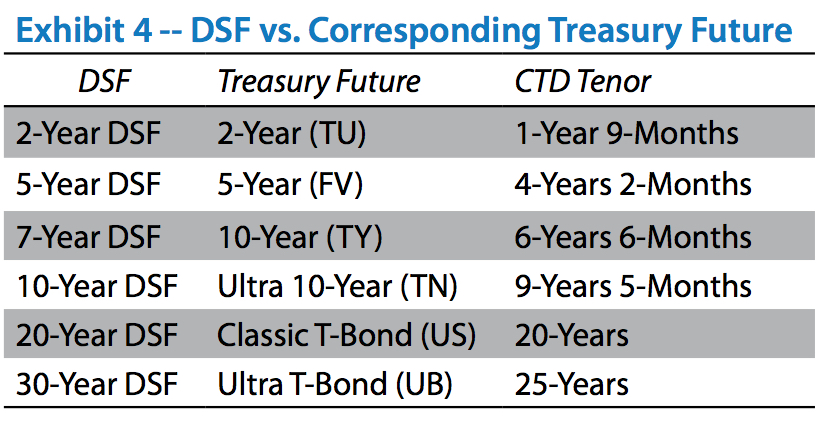

Exhibit 4 illustrates the current price and yield dynamics of Treasury futures and their corresponding DSF contract:

It is worth noting that the lack of Treasury bond issuance between 2001 and 2006 leads the US contract to reflect yield and price dynamics in the 20- to 22-year neighborhood of the Treasury yield curve.

The following sections of this note will demonstrate how one could spread Treasury futures and DSFs to achieve very similar results to the traditional cash swap spread, while also benefiting from the significant capital savings offered by futures products.

Managing Risk with DSFs

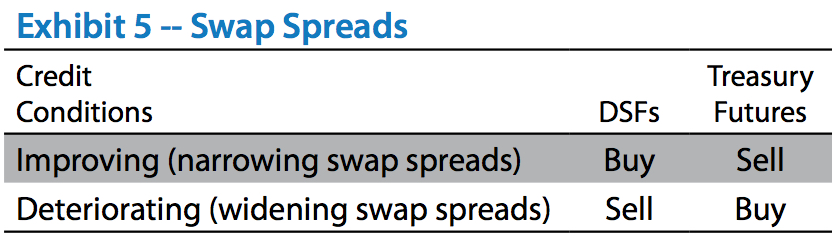

Spreading IRS against Treasury securities with comparable underlying terms to maturity is a familiar means of trading the swap spread, ie, the interest rate spread between money center bank credit exposure and US Treasury credit risk. Spreads between DSFs and Treasury futures enable users to synthetically acquire or hedge swap spread exposures (or other credit spread exposures that are reasonably correlated with swap spreads.)

In any such instance, the appropriate futures spread ratio is built on the relative interest rate sensitivities of the legs of the spread, i.e., the dollar value per futures contract of a one basis point (bp) per annum change in the contract’s respective underlying interest rate exposure (basis point value, or BPV). For example, let BPVTN be the dollar value of change in a TN contract’s price associated with a change of one bp in Treasury yields of the CTD issue, and let BPVDSF be the dollar value of change in DSF contract price arising from a one bp change in the corresponding delivered IRS fixed rates. The spread ratio between the two, expressed as number of DSFs per TN, is:

Spread Ratio = BPVTN / BPVDSF

Spreading TN with 10-Year DSFs

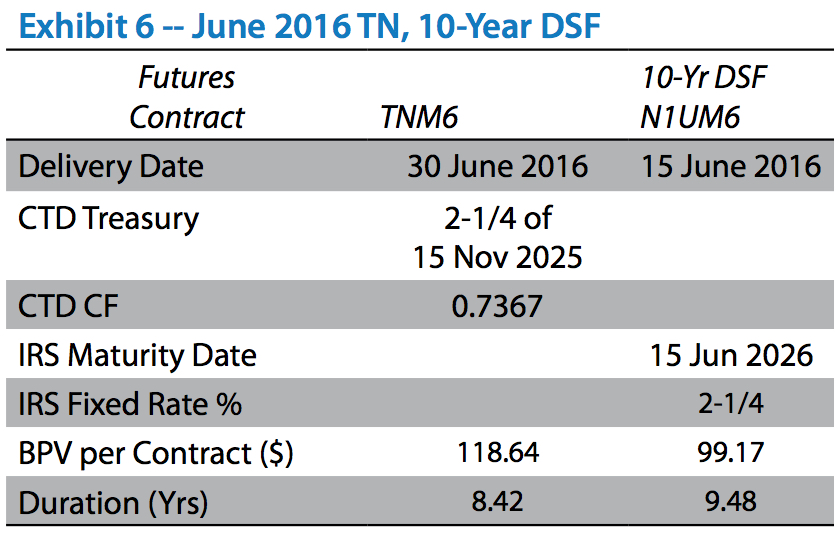

The following example demonstrates a TN-DSF spread at approximately the 10-Year point. TN is assumed to be for June 2016 delivery (TNM6), for which the cheapest-to-deliver contract-grade Treasury note is assumed to be the 2-1/4% of 15 November 2025 with a conversion factor (CF) of 0.7367 for June 2016 deliveries. For the June 2016 10-year DSF (N1UM6) the contract grade is a 10-year plain-vanilla IRS with a fixed rate of 2-1/4 percent per annum for delivery (i.e., with a swap effective date) on Wednesday, 15 June 2016. (Exhibit 6)

When assessing the interest rate sensitivity of a Treasury futures contract, a reliable approach is to find the forward BPV of the CTD security (BPVCTD), with the most probable futures delivery date serving as the forward date, then to deflate the result by the corresponding delivery conversion factor. In these examples, taking the premise that the last delivery date (Thursday, 30 June 2016) is the most likely, the forward BPV of the Treasury issue is $87.40 per bp per $100,000 face value. Combining the ingredients gives us $118.64 per bp per contract as the BPV for TNM6:

BPVTN = BPVCTD / CFCTD = $87.40 / 0.7367 = $118.64

Assuming one aims to either shed or acquire swap spread exposure by spreading 10-year DSFs against TN, the BPV-weighted spread ratio would be 1.20, or 120 10-year DSFs long (short) for every 100 TY contracts short (long) –

BPVTN / BPVN1U = $118.64 / $99.17 = 1.20

While this approach may be adequate for some purposes, the slight difference in tenor of the two legs— 9-years 5-months for the Treasury future and 10-years for the DSF — incorporates an element of yield curve exposure in addition to the desired swap spread exposure.

Cash Swap Spread vs Futures Swap Spread

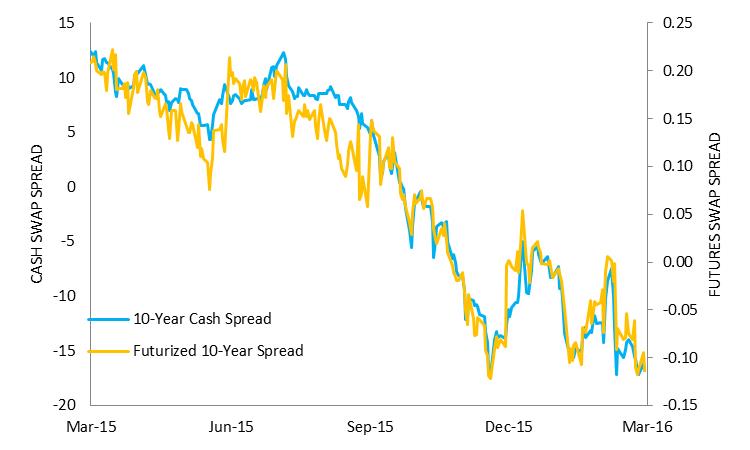

For those firms expressing views on swap spreads, the traditional trading methodology requires combining an OTC spot-starting interest rate swap (IRS) with a Treasury security. With the introduction of DSFs, market participants can futurize this spread by combining a deliverable swap future and U.S. Treasury future—achieving closely correlated outcomes with significant capital efficiencies. Exhibit 7 illustrates the close relationship between the futurized 10-year swap spread and the 10-year cash swap spread from March 2015 to March 2016:

Exhibit 7 – Cash Swap Spread vs Futures Swap Spread

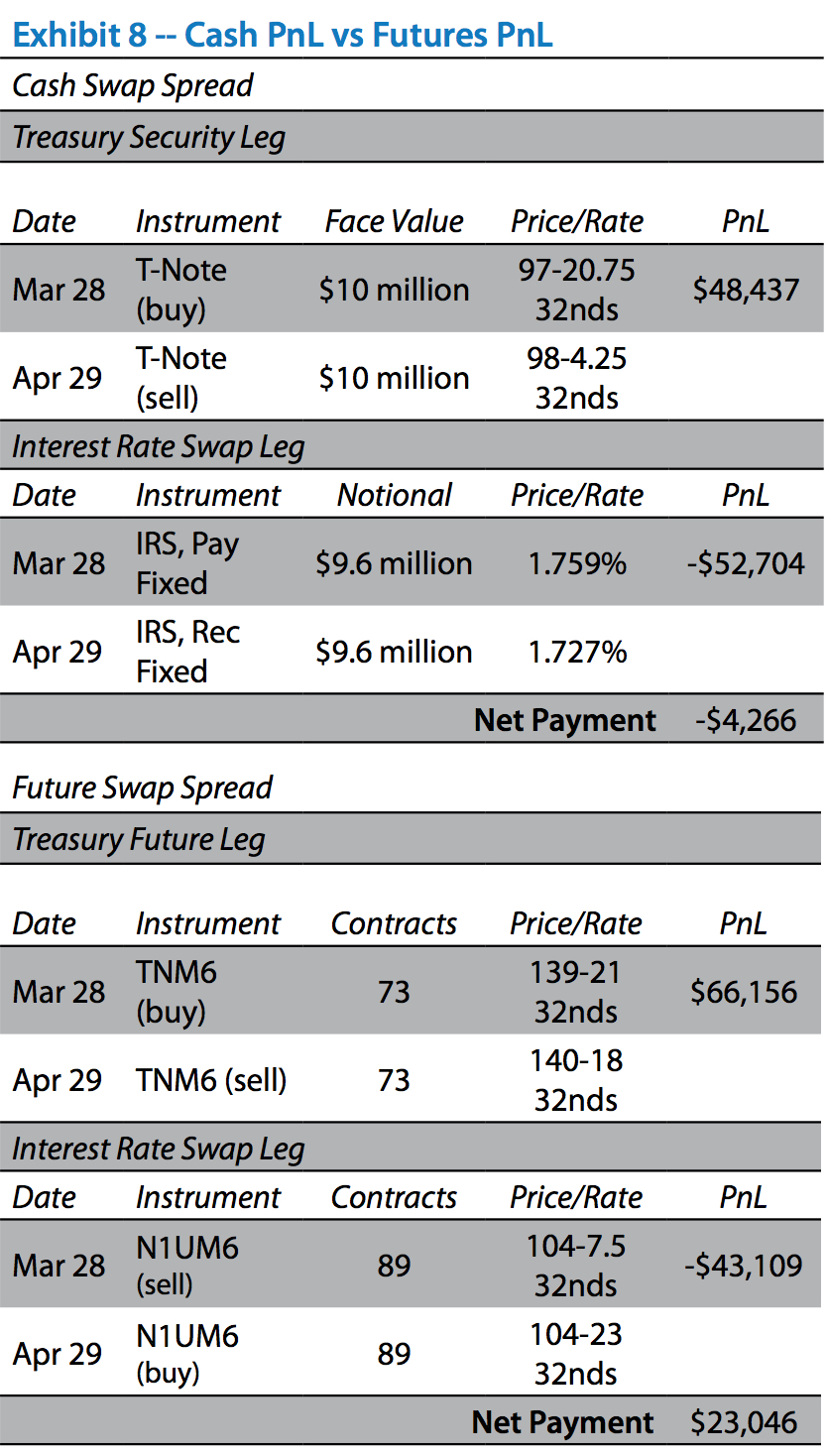

Exhibit 8 details a scenario in which a market participant compares the PnL results of a cash swap spread using 10-year Treasury notes against 10-Year OTC IRS, and a futures swap spread of the 10-Year Treasury note futures (TN) against 10-year DSFs:

Because the resultant net payments of the two types of spreads are closely related, the more advantageous methodology of trading the swap spread can be found in the type of spread that has the higher net payment:capital requirement ratio.

The futurized version of the swap spread (DSFs and Treasury futures) is created using two contracts traded through, and cleared via, the Exchange. This allows for risk offsets that are applied the moment the positions are cleared—significantly reducing the capital requirements to complete the spread.

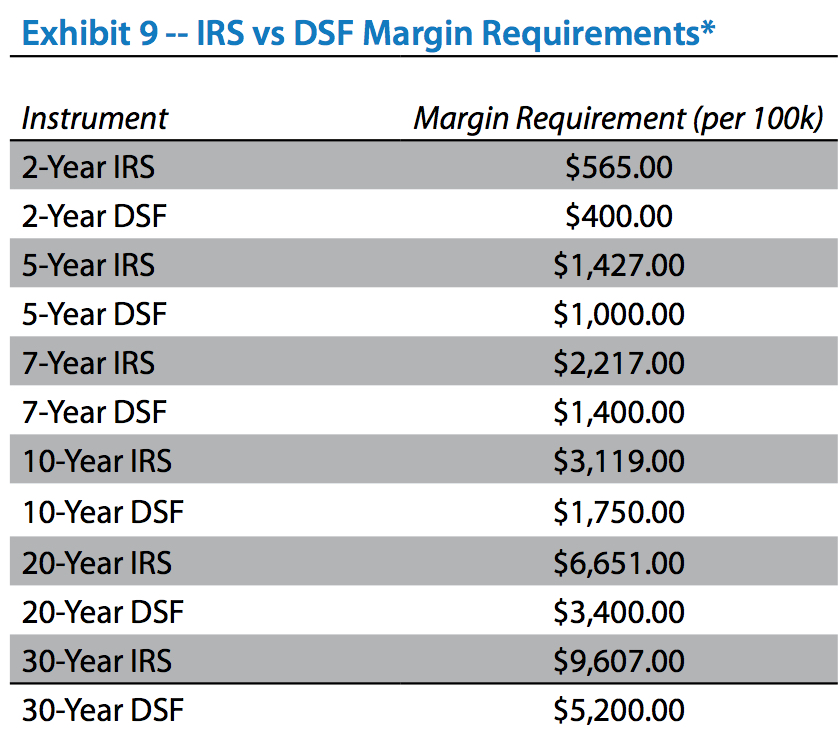

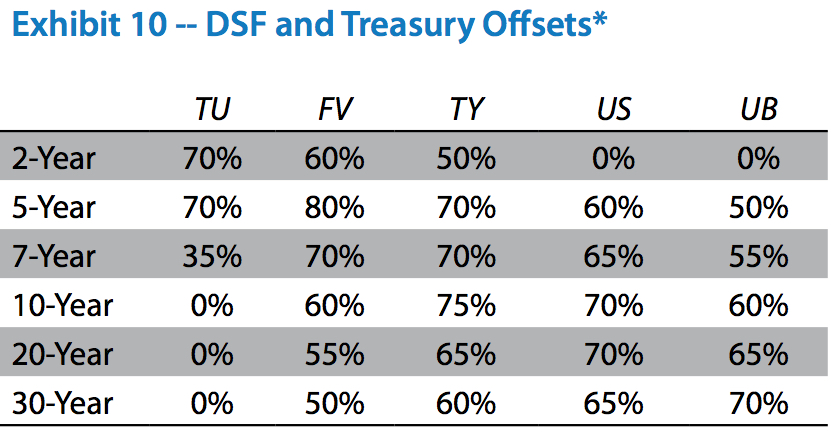

The cash efficiencies achieved by utilizing DSFs (futurized interest rate exposure) as opposed to IRS (OTC interest rate exposure) are further illustrated in Exhibit 9, which details the margin requirements for the aforementioned products. Exhibit 10 illustrates the percentage margin offset currently offered for DSF and Treasury futures products.

*As of April 7, 2016. For more information on futures margins please visit CME Group Margins at http://www.cmegroup.com/clearing/risk-management/performance-bonds-margins.html.

Cash Efficient Hedging

DSF contracts offer as highly correlated hedging abilities of interest rate risk exposures as OTC IRS, but with significant gains in operational efficiency.

The current methodology for portfolio margining OTC IRS and Treasury futures requires transferring cleared futures positions into cleared OTC swaps margin accounts. While this does not impact overall positions in the IRS or futures trading accounts, it necessitates an additional layer of operational diligence during the end-of-day position management process.

Because DSFs are futurized OTC interest rate swaps, there are immediate risk offsets against other interest rate futures held in CME futures position accounts. DSFs offer firms that are unwilling or unable to transfer Treasury futures into OTC IRS margin accounts the ability to achieve the cash efficiencies of portfolio margining IRS and Treasury futures without requiring transferring positions between margin accounts. This not only provides a more efficient method for reducing overall margin requirements, but also reduces operational requirements and communication between Clearing Firms and the Exchange during the end-of-day settlement and position management process.

Benefits of Executing in Futures Markets

The benefits of using CME DSFs and Treasury futures to establish swap spread positions include off-balance sheet exposures, counterparty credit risk mitigation, greater capital efficiencies, standardization, and price transparency. Customers can develop opposite long/short positions in DSFs and Treasury futures by executing in the transparent, anonymous and liquid markets available on CME Globex or by executing block trades provided that each leg meets its respective minimum size requirement. Additionally, customers may also create equal and opposite DSF and Treasury futures positions by utilizing pre-defined, implied intercommodity spreads that eliminate risk of legging positions in outright markets.

About the authors:

Jonathan Kronstein, Senior Director, Research & Product Development. Kronstein joined CBOT (now CME Group) in 2002 and served as Senior Economist from 2004 – July 2007. Prior to joining CBOT, Kronstein provided research, sales and execution services for institutional customers of Refco Group. Kronstein earned the Bachelor of Arts degrees in economics and philosophy from the University of Notre Dame and the Master of Business Administration in economics and finance from the University of Chicago, Booth School of Business.

Nicholas Johnson, Economist, Research & Product Development. Between 2013 and April 2015, Johnson served as a Senior Operations Analyst within the CME Group clearing house. Johnson earned the Bachelor of Arts degree in economics from Northwestern University in 2013.

Frederick Sturm, Executive Director, Research & Product Development served as Senior Economist with the Chicago Board of Trade (now CME Group). Prior to joining the CBOT Sturm was First Vice President of Futures and Options Research with Fuji Futures (now Mizuho Securities USA) and an analyst with Carr Futures (now Société Générale). Sturm earned the Bachelor of Arts degree in economics from Indiana University and the Master of Arts and Master of Philosophy degrees in economics from Columbia University.

The information within this brochure has been compiled by CME Group for general purposes only. CME Group assumes no responsibility for any errors or omissions. Additionally, all examples in this brochure are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience.

For persons based in the EEA, this brochure has been issued by CME Marketing Europe Limited. CME Marketing Europe Limited (FRN: 220523) is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

The information contained in this brochure is provided as is and without any warranty of any kind, either express or implied. CME Group assumes no responsibility for any errors or omissions.

The information and any materials contained in this brochure should not be considered as an offer or solicitation to buy or sell financial instruments, provide financial advice, create a trading platform, facilitate or take deposits or provide any other financial products or financial services of any kind in any jurisdiction. The information contained in this presentation is provided for information purposes only and is not intended to provide, and should not be construed as, advice. It does not take into account your objectives, financial situation or needs. You should obtain appropriate professional advice before acting on or relying on this material.

Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade. All references to options refer to options on futures.

CME Group and are trademarks of CME Group Inc. The Globe logo, E-mini, E-micro, Globex, CME and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. (“CME”) CBOT and Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. (“CBOT”). ClearPort and NYMEX are trademarks of the New York Mercantile Exchange, Inc. (“NYMEX”) These may not be modified, reproduced, stored in a retrievable system, transmitted, copied, distributed or otherwise used without the written permission of the party owning these materials.

Treasury futures and options are subject to the rules and regulations of CBOT.

All matters pertaining to rules and specifications herein are made subject to and are superseded by official Exchange rules. Current rules should be consulted in all cases concerning contract specifications. CME, CBOT and NYMEX are each registered as a Recognized Market Operator in Singapore and authorized as Automated Trading Service providers in Hong Kong S.A.R. Further the information contained herein does not constitute the provision of direct access with any foreign financial instrument market or clearing services for foreign financial instrument market transactions defined under Japan’s Financial Instrument & Exchange Act (Law No. 25 of 1948, as amended). CME Europe Limited is not registered or licensed to provide, nor does it purport to provide financial services of any kind in any jurisdiction in Asia including Hong Kong, Singapore or Japan.

None of CME Group entities are registered or licensed to provide, nor does it purport to provide, financial services of any kind in People’s Republic of China or Taiwan. This brochure is for distribution in Korea and Australia solely to “professional investors”, as defined in Brochure 9(5) of the Financial Investment Services and Capital Markets Act and related rules and in the Corporations Act 2001 (Cth) and related rules respectively, circulation should be restricted accordingly.

Copyright © 2016 CME Group and all rights reserved.