May 2014

By Blu Putnam, Chief Economist and Samantha Azzarello, Economist, CME Group

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the authors and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice, a solicitation of purchases or sale of any futures or options or the results of actual market experience.

Exposure to metals, especially gold, silver, copper, platinum, palladium and aluminum, can add interesting opportunities to enhance the risk management of more traditional portfolios focused on equities. To gain maximum advantage from the use of metals exposures in broader-based portfolios, however, there is a need for active risk management. Metals can develop persistent trends, but they can also reverse course or enter periods of heightened volatility. Of course, this is true for virtually every asset class, including equities, fixed income, currencies, energy and agriculture. What is important to appreciate, and is the focus of this report, is the special nature of the interrelationships among various metals. In this report, we will highlight and examine the following characteristics of selected metals:

➪ Gold remains the best portfolio diversifier with virtually no correlation to US equities in growth or crisis periods.

➪ Scenarios for gold’s future price performance appear to hinge on inflation pressures developing and whether or not the US Federal Reserve will choose to delay raising the federal funds rate.

➪ Correlations with US equity returns from the returns of industrial metals (i.e., gold is excluded from this group) have been slowly rising since the financial crisis, at least until recently.

➪ In the financial crisis of 2008-2009 volatility spiked in all the metals, but as the recovery took hold, volatility quickly fell back to pre-crisis levels.

➪ Scenarios for core industrial metals, such as aluminum and copper, are being impacted by divergent factors. The move by some automobile companies to use aluminum in the frames of light trucks represents a potential positive. In China, though, the deceleration of growth and appearance of challenges in the shadow banking sector have hit copper prices.

➪ With specialty metals, like palladium, its wide use in the catalytic converters of automobiles ties its price future to the continued resurgence of that industry.

We will divide our research report into two sections. First, we want to focus on the characteristics of metals in a portfolio context, looking not just at return trends, but also at volatility and correlation patterns. Second, we will look to the future and try to highlight a few of the key issues facing selected metals.

I. Portfolio Analytics

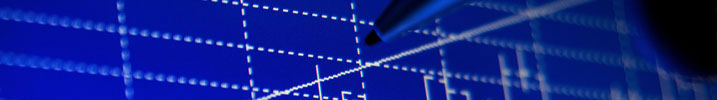

Metals responded quite differently to the changing economic conditions of the past 10 years. During the growth period, led by China and other emerging market nations, from 2003 through 2006, prices were generally on a strong upward trajectory across the asset class. The financial panic of September 2008, which lasted into March 2009, brought strong price reversals for the industrial metals, but not for gold and silver (See Figure 1). The recovery period, 2010 to the present, has seen mixed economic performances from both mature and emerging economies, including stagnation in Europe and deceleration of growth in the emerging market world. This has led to more complex price patterns in the metals sector.

Figure 1.

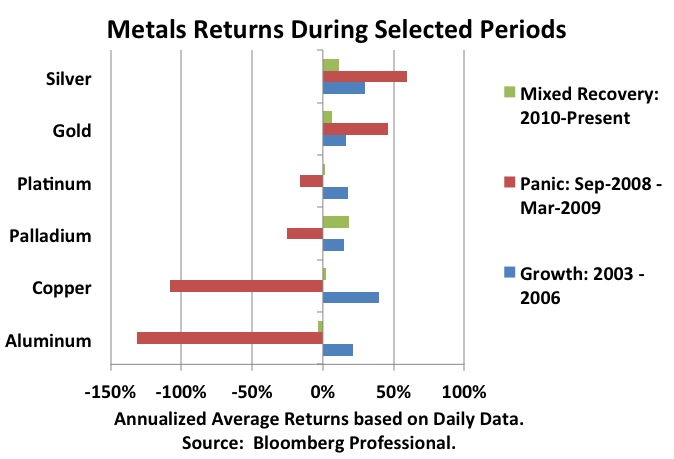

Just looking at returns, however, only provides part of the picture. When we look at the shifting nature of volatility, what we observe is that regardless of the price direction during the financial panic period, volatilities surged higher, roughly doubling their pre-crisis volatility. Then after the panic subsided, the volatility regime returned to its old self (See Figure 2). The mean-reverting nature of volatility patterns in the metals sector is quite consistent, regardless of the metal and regardless of the cause of the volatility shock.From a portfolio perspective, the roughly doubling of volatility in a panic or distress period means that metals positions, whether they rise or fall, are going to dramatically raise the embedded risk when or if a crisis occurs. From an options perspective, the value of a call or put option, holding everything else equal, will also rise dramatically with a surge in volatility. That is, when substantial shifts in volatility regimes are possible or becoming more probable, there is an enhanced role for options exposures in risk management. The case for more active options management is strengthened by the pattern of mean-reversion in volatility. Since volatility spikes are typically accompanied by sharp price movements, the prices of call and put options are greatly impacted and often display very different implied future expected volatilities for shorter-dated options versus longer-dated ones, and for in-the-money options versus deep out-of-the-money. These implied volatility profiles offer enhanced opportunities for active risk management depending on whether one adopts the typical scenario of mean-reverting volatility or the less likely alternative scenario that a permanent shift in the volatility regime has occurred.

Figure 2.

Moving past volatility, one of the key challenges of portfolio risk management is to understand the correlation structure. What is fascinating in the metals sector is the relative stability of correlations moving across very different economic environments, from the growth period of the early 2000s, to the financial panic, and then to the recovery phase. Despite the shifting in the volatilities from regime to regime, the correlation patterns were much more stable.

Moving past volatility, one of the key challenges of portfolio risk management is to understand the correlation structure. What is fascinating in the metals sector is the relative stability of correlations moving across very different economic environments, from the growth period of the early 2000s, to the financial panic, and then to the recovery phase. Despite the shifting in the volatilities from regime to regime, the correlation patterns were much more stable.

Using simple correlation coefficients based on daily returns, a 1.0 indicates perfect association, while negative coefficients represent inverse return movements. For example, taking two industrial metals, the correlation of copper returns compared to aluminum returns was a relatively strong 0.64 in the growth period, 0.71 in the panic period, and 0.71 in the recovery phase. Even for gold returns where correlations to industrial metal returns are typically lower, there was relative stability. The gold returns to copper returns correlations through the three periods were 0.39, 0.22, 0.37, respectively.

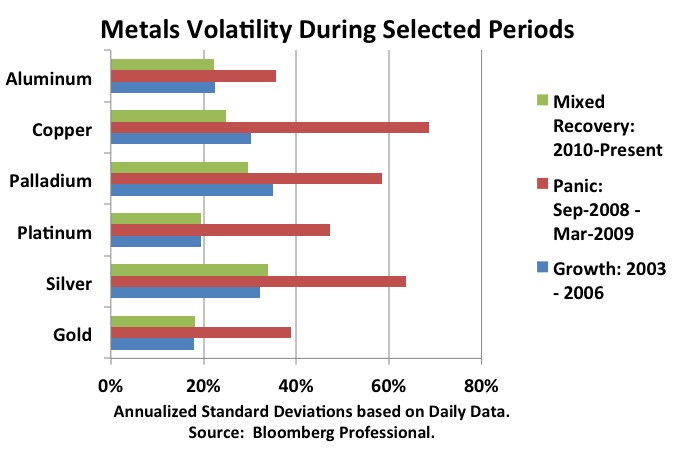

Relative to US stocks, as measured by the return performance of the S&P500 Index, interestingly, there have been some evolutionary shifts in the correlation patterns with the industrial metals. In the pre-crisis growth period, return correlations in the metals sector to the S&P500 were ina tight band from -0.06 for gold, to 0.11 for copper, with the other metals in between. These are exceptionally low correlations suggesting no patterns of association at all. In subsequent periods, though, the metals correlations to the S&P500 started to rise, with the exception of gold. That is, for silver, palladium, platinum, copper, and aluminum, the return correlations relative to the S&P500 during the financial panic period ranged from 0.23 (platinum) to 0.31 (copper) – still low correlations but clearly rising from the growth period. Then, in the latest recovery phase, the range bumped higher again to 0.27 (silver) to 0.49 (palladium). This new and somewhat higher correlation pattern for industrial metals has been interrupted, however, by the deceleration of economic growth in China, which has especially effected the correlation between cooper and S&P500 returns.

Figure 3.

By contrast, gold maintained a low return correlation with the S&P500 regardless of the economic or market environment, running from -.06, 0.03, 0.10, respectively, for the three periods. That is, price performance aside, gold remains the metal offering the least correlation to equities and the most diversification potential.

By contrast, gold maintained a low return correlation with the S&P500 regardless of the economic or market environment, running from -.06, 0.03, 0.10, respectively, for the three periods. That is, price performance aside, gold remains the metal offering the least correlation to equities and the most diversification potential.

We note, though, that the topic of diversification potential introduces some counter-intuitive concepts, at least for some market participants. One class of market participants typically wants to make money on every position they take and would never incorporate a position expected to lose money in their holdings. While another class of market participants appreciates the value of hedging and understands that by definition a hedge is expected to lose money when the core exposure is making money. That is, one would not take on the hedge exposures at all unless one owned the core exposure and expected it to appreciate over the longer-term. Nevertheless, losing money on a hedge, even though the expected return from the hedge is negative, is not always fun. Second-guessing is common concerning the size of the hedge, or even whether to hedge or not, which brings us to the second part of our report that focuses on more recent trends and possible scenarios in the metals sector.

II. Scenarios for the Future

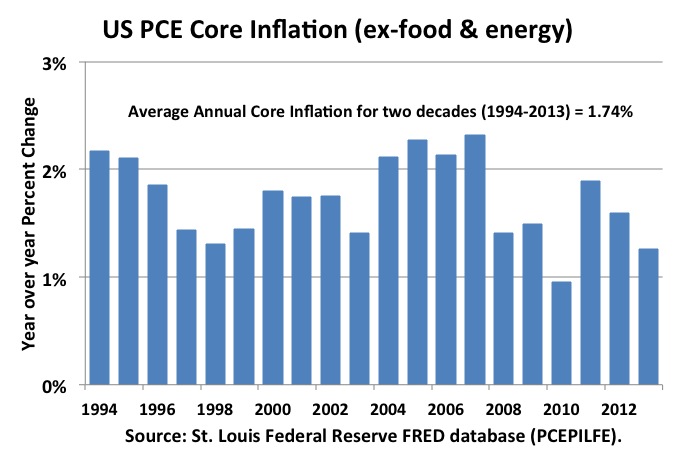

A. Gold. While gold offers the most diversification potential for portfolio risk management, it is challenged from a return expectations perspective in the current environment. Gold tends to appreciate in a financial crisis as store of value and flight to quality asset. Gold tends to appreciate when inflation is rising. Gold tends to appreciate when demand for jewelry and precious metals is high in China and India, the two largest sources of global demand for gold. In the current context, probabilities of financial disaster have receded with central bank actions and banking reforms requiring higher capital ratios. There are no observable inflation pressures in the US (See Figure 4) or Europe, India has raised its tariffs on gold imports to high levels and economic deceleration in China has reduced the growth rate of demand for gold. That is, if one adopts the scenario that we will see more of the same over the next months and years, then the case for a sustained upward trend in gold prices is weak.

Figure 4.

One scenario that produces expectations of higher gold prices involves the emergence of inflation pressures in the US, coupled with the Federal Reserve intentionally staying behind the curve and allowing inflation pressures to develop before contemplating raising the target federal funds rate. To date, there is no evidence of inflation pressures; however, the forward guidance from the Federal Reserve does suggest they plan to stay behind the inflation curve and delay raising their target federal funds rate for a very long time into the future.

One scenario that produces expectations of higher gold prices involves the emergence of inflation pressures in the US, coupled with the Federal Reserve intentionally staying behind the curve and allowing inflation pressures to develop before contemplating raising the target federal funds rate. To date, there is no evidence of inflation pressures; however, the forward guidance from the Federal Reserve does suggest they plan to stay behind the inflation curve and delay raising their target federal funds rate for a very long time into the future.

B. Aluminum and Copper. Aluminum and copper are core industrial metals. When emerging market countries are expanding at a rapid rate and initiating many new infrastructure projects as they were in the early 2000s, both of these metals are likely to see sustained rising price trends. Those days, however, have receded into the past, with decelerating growth across the emerging market economies. To develop a scenario for future sustained upward price trends in aluminum and copper, one would need to project stronger economic growth, especially in the developing world. There are signs that the currency contagion fears and underperformance of emerging market equities may be abating, but rising political risks in the emerging market countries remains a negative factor holding down growth expectations.

Figure 5.

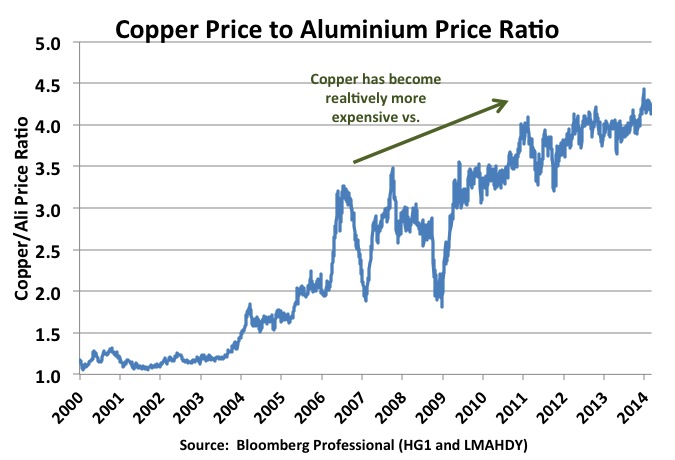

One may also wish to consider relative return considerations. Copper returns outperformed aluminum returns, with a sustained trend from 2003 through 2013 (see Figure 5). Through the growth period, the financial panic, and the more recent recovery phase, the ratio of copper to aluminum prices continued to rise. One scenario, of course, is to extrapolate trends and expect them to continue indefinitely, and that is certainly possible. New developments for both aluminum and copper, however, are shifting the probabilities among possible scenarios. For example, the US automobile industry is testing whether they can further expand the use of aluminum in the frames of light trucks, as Ford is doing, to save weight and increase gasoline mileage. This has the potential to increase aluminum demand long-term if consumers accept the lighter frames.

One may also wish to consider relative return considerations. Copper returns outperformed aluminum returns, with a sustained trend from 2003 through 2013 (see Figure 5). Through the growth period, the financial panic, and the more recent recovery phase, the ratio of copper to aluminum prices continued to rise. One scenario, of course, is to extrapolate trends and expect them to continue indefinitely, and that is certainly possible. New developments for both aluminum and copper, however, are shifting the probabilities among possible scenarios. For example, the US automobile industry is testing whether they can further expand the use of aluminum in the frames of light trucks, as Ford is doing, to save weight and increase gasoline mileage. This has the potential to increase aluminum demand long-term if consumers accept the lighter frames.

By contrast and as noted previously, when discussing correlation patterns, copper has a new challenge coming from China. During China’s high growth rate and infrastructure building phase, copper was also stored and used as a form of collateral for lending by the shadow banking sector. As China’s economic growth rate has decelerated and as its government has begun to push the economy toward a domestic-consumption model rather than focusing on infrastructure building, the shadow banking sector has come under pressure. The weakness in the shadow banking sector has manifested itself in the release of some copper stocks held in inventory as loan collateral, and thus has put downward price pressure on copper. Evaluating the extent of the credit issues in China and the possibility for government intervention, however, is exceedingly difficult, as by definition the shadow banking system is opaque.

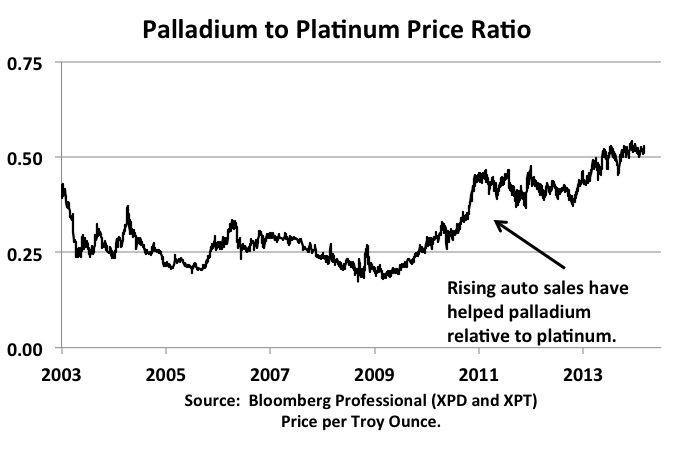

C. Palladium and Platinum. Palladium and platinum are more in the category of specialty industrial metals, although platinum also has a role in jewelry. The historical volatility patterns of these two metals mirrored the rest of the sector, with a large spike in the financial panic period and then a reversion to pre-crisis volatility levels. But the price performance of these two metals did not produce the out-sized returns of gold, silver, copper, or aluminum in the pre-crisis growth period, or the out-sized losses that copper and aluminum had in the crisis period.

Figure 6.

More recently, in the recovery phase, palladium has been the leader in price performance. Palladium is part of the “platinum” group of metals, having a relatively low density and claiming fame with its very low melting point. This has made palladium a key metal for use in catalytic converters that assist with pollution control in automobiles. As the automobile sector has recovered after the financial panic, palladium has had a nice relative price rise compared to platinum. Future scenarios for palladium, therefore, depend quite critically on one’s perspective as to whether global automobile sales will continue to power upward or whether there was a post-crisis bump in automobile sales that has run its course and that slower growth rates in that sector are more likely.

More recently, in the recovery phase, palladium has been the leader in price performance. Palladium is part of the “platinum” group of metals, having a relatively low density and claiming fame with its very low melting point. This has made palladium a key metal for use in catalytic converters that assist with pollution control in automobiles. As the automobile sector has recovered after the financial panic, palladium has had a nice relative price rise compared to platinum. Future scenarios for palladium, therefore, depend quite critically on one’s perspective as to whether global automobile sales will continue to power upward or whether there was a post-crisis bump in automobile sales that has run its course and that slower growth rates in that sector are more likely.

Risk Management Conclusions

The metals sector offers important risk management characteristics in light of price trends, volatility regimes and correlation patterns. Low and stable correlations may offer diversification to equity-based portfolios. The mean-reverting nature of volatility spikes adds new dimensions for active risk management using options. More specifically, our conclusions may be summarized as follows.

Gold remains an especially useful diversification tool, because of its low correlation with equity returns in virtually all market conditions. Gold, however, faces some challenges regarding price behavior, depending in no small way on whether or not inflation pressures develop in the US and what actions the Federal Reserve chooses to take.

Volatility in the metals sector appears to be mean-reverting. That is, when a crisis occurs, volatility surges, and then returns to pre-crisis levels afterwards. This means that risk managers may need to stress test metals portfolios with crisis level volatilities to understand how much embedded risk is in the portfolio and not necessarily reflected in more recent historical volatility patterns.

Correlations among the industrial metals (i.e., not including gold) have been slowly rising relative to US equities. There was virtually no correlation in the emerging market growth period in the early 2000s, but since the financial crisis of 2008, return correlations of industrial metals with the S&P500 have been rising, although they are still relatively low. This rising pattern may be interrupted, however, especially for copper, given the concerns over its role in China’s shadow banking sector.

Relative value propositions among pairs of metals are coming into focus for many market participants. The automobile industry is partly responsible, on the one hand, and China on the other. As the automobile sector has rebounded, this has supported palladium as the key metal used in catalytic converters. With the trend toward using more aluminum in vehicle frames to save weight and increase gas mileage, aluminum may get a relative price lift in the future compared to copper. The future for copper is uncertain and partly tied, as noted earlier, to China and challenges with its shadow banking sector that have resulted in some copper inventories being released into the spot market.

About the authors:

Bluford (Blu) Putnam has served as Managing Director and Chief Economist of CME Group since May 2011. He is responsible for leading economic analysis on global financial markets by identifying emerging trends, evaluating economic factors and forecasting their impact on CME Group and the company’s business strategy. He also serves as CME Group’s spokesperson on global economic conditions and manages external research initiatives.

Samantha Azzarello has served as an Economist of CME Group since 2012. She is responsible for conducting macroeconomic research and analyzing domestic and global economic developments that impact the company’s business. Azzarello has conducted analysis on the relationship between power and natural gas, which she presented to regional power producers and agencies. Azzarello earned her bachelor’s degree from the University of Toronto and she holds a master’s degree from New York University.