Mini-DAX ® Futures: The easy way to trade the DAX® is written by Matthew Scharpf, VP Fixed Income Derivatives and Clearing Sales, Eurex

The DAX® Equity Index futures contract on the Eurex Exchange represents Germany’s 30 largest and most actively traded companies. It has been a benchmark Equity index futures contract on the Eurex Exchange for decades, but over the years the growth in notional value of the DAX® has grown immensely due to Germany’s resilient and robust economy, the contract’s €25 tick size and because the DAX® is a performance Index where dividends are reinvested into its price.

With that design, the notional value of the DAX® Futures contract has outpaced other benchmark index futures both globally and at Eurex Exchange. With the DAX® reaching levels of up to 12,000 points, the contract size of the DAX® Futures recently peaked at 300,000 EUR.

Until recently, retail traders and smaller institutional firms who wanted to trade or hedge Germany’s biggest 30 companies or its volatility accurately couldn’t do so, because the DAX® contract became simply too “heavy.” For bigger institutions, it developed into something too difficult to use to hedge exposure precisely.

The Mini-DAX® helps invite these participants with a contract value 1/5 the size of the full contract making trading Germany’s Big 30 more accessible to more traders. A smaller contract also means a lower margin requirement, allowing for creative strategic flexibility via potentially multiple open positions. The benchmark DAX® contract is €25 per point and for a range that can reach 200 points daily, €5,000 per contract can be too much for too many who want to express their opinion in the German equity index market. The Mini-DAX®, with its 1/5 size, would cut that by 80% and allow traders to risk a more reasonable €1,000 from a 200-point range.

At €25 per point, the DAX® contract has become an expensive instrument, making it difficult to use for hedging dynamic long-term cash positions. Such a blunt instrument can be tough to apply to an ever-changing portfolio. In time, the Basis Risk starts to diverge the hedge from its purpose. With the more precise terms of the Mini-DAX®, the hedge is now likely to correlate accurately.

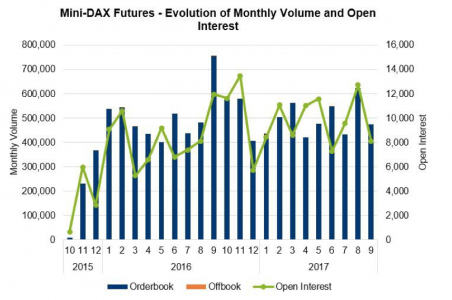

For this and many other reasons, a smaller version of the DAX® was released two years ago this month, and the Mini-DAX® has answered many customers’ wishes. Its ADV is 18,000 contracts and Open Interest has grown to 8,400. The Mini-DAX® has not cannibalized the “BIG DAX” but only enhanced it by offering a different way to trade the same underlying.

Another driver for creating a smaller contract was the German CFD market. Volumes in the German CFD space reached 1,962 billion EUR in 2015. By the end of 2016 the market reached 1,847 billion EUR. 90% thereof is allocated in indexes (~1,700 bn EUR); 81% of the index volume is invested into DAX®(>1,375 bnEUR). That level of volume corresponds to a potential 85,000 Mini-DAX® Futures per day at a DAX-Level of 12,800.

With that much volume to exploit, educating and marketing to retail traders became a large focus for CFD providers. However, the Swiss monetary decision in 2015 caused many CFD’s to suffer from extremely high leverage together with Market Makers pulling their prices, resulting in a number of insolvencies amongst brokers and their clients. Participants and brokers who survived started looking for an alternative to CFD’s with benefits that lessened their risk.

Enter the Mini-DAX®: A higher number of Market Makers, more risk-adequate margins, a central clearing house, as well as better regulation and oversight all speak to the stability of futures contracts over other instruments representing the German market. With its design being related to the DAX® future but on a smaller scale, the attractive nature of the Mini-DAX® is difficult to replicate. The volumes and open interest over such a short time period tell the story.

Since October 2015, Eurex has offered Mini-DAX®-Futures (FDXM) in parallel to the popular DAX®-Futures (FDAX) with a significant lower contract value of just EUR 5.

More than 11.2 million contracts have been traded since launch by over 175 Eurex members.

All advantages at a glance:

- A contract size of EUR 50,000 (if DAX® is at a level of 10,000)

- Lower margin of roughly of EUR 4,700 (estimate)

- Optimized risk protection through easy to trade positions and exchange sponsored risk-controls

- Transparent and liquid order book thanks to multiple Market Makers

- Safety of fulfillment as Eurex Clearing mitigates counterparty risk

- Stable spread between 1-2 ticks

- OI > 8,000

- 2017 ADV > 23,000

- Account structure: Agency business 23%, Market Making 55%, Proprietary Trading 22%

- Market share FDXM FDAX has reached ~ 6.0 % notional volume

Another benefit of the Mini-DAX® is nearly netting risk fungibility: the margins paid for 5 Mini-DAX® Futures (long) will be reduced significantly by margins paid for FDAX (short).

Eurex is able to offer greatly reduced (but not fully offsetting) margins between the FDAX and Mini-DAX®, but because each product possesses different levels of liquidity, the margin requirement for a market neutral position will only be very close to zero under Eurex Clearing’s Prisma (Portfolio Risk Margining protocol).

On the trading level, the Mini-DAX® is nearly fungible in that with separate order-books, an order to buy 5 Mini-DAX® Futures is positionally equivalent to sell 1 FDAX Future in its order-book.

Because customer consultations indicated a preference for separate contracts to trade one against the other, the FDAX and Mini-DAX® have completely separate order-books while they both will quarterly settle in cash.

On the clearing level it is an ongoing discussion about potentially allowing a long position in 5 Mini-DAX® Futures to be netted out against one short position in the FDAX.

Eurex is currently not able to offer cross-product netting, as open interest of longs and shorts per product needs to be absolutely identical. Eurex might make this functionality available at a later stage, e.g. by booking the netted-out positions on a dummy account.

Summary

With Mini-DAX® Futures, Eurex offers an instrument suited for many: From retail traders to large hedgers who need a finer tool to trade Germany’s 30 largest companies. Eurex is pleased with its growth and expects it to continue being a viable alternative to other riskier or uncleared instruments representing German corporate equity baskets.

For more Information:

US 312-544-1210

Germany 49-69-211-11210

http://www.eurexexchange.com/exchange-en/products/idx/dax/Mini-Dax–Futures/2208132

DISCLAIMER This publication is published for information purposes only and shall not constitute investment advice respectively does not constitute an offer, solicitation or recommendation to acquire or dispose of any investment or to engage in any other transaction. This publication is not intended for solicitation purposes but only for use as general information. All descriptions, examples and calculations contained in this publication are for illustrative purposes only. Eurex and Eurex Clearing offer services directly to members of the Eurex exchanges respectively to clearing members of Eurex Clearing. Those who desire to trade any products available on the Eurex market or who desire to offer and sell any such products to others or who desire to possess a clearing license of Eurex Clearing in order to participate in the clearing process provided by Eurex Clearing, should consider legal and regulatory requirements of those jurisdictions relevant to them, as well as the risks associated with such products, before doing so.