February 2017

Special Report by

Blu Putnam, Chief Economist, CME Group

The sweeping Republican victory in the 2016 U.S. elections to win the White House, Senate and House of Representatives could break years of political gridlock in Congress. This breakthrough is likely to set the stage for the new administration to forge ahead with promised fiscal policies aimed at escalating growth in the world’s largest economy. But shaping that fiscal policy will not be easy, even if the broad direction is relatively clear.

Perhaps the most vexing fiscal policy question facing the Republican Party is how fast to allow the federal government’s debt to rise over the next four years. More than any other metric, the national debt as a percent of nominal GDP in the eyes of the press and the public reflects the size of the role Washington plays in the economy and the implied burden on future generations. Currently, the debt of the U.S. Treasury stands just above 100% of GDP—a very symbolic threshold, even if arbitrary and not necessarily economically meaningful.

Central to the issue over the likely rise in the national debt are two key challenges to be sorted out by the Republican White House, Senate and House of Representatives over the next few months. First, will tax reform embrace a large net tax cut or will the tax reform attempt to be structured in a revenue neutral manner? Second, will government spending be expanded for infrastructure and military spending, or will spending plans focus on shifting budgeted money around rather than increasing it? Our view is that tax reform is the more urgent priority of the Republican Congress and infrastructure spending legislation will be delayed until later in 2017. Thus, in this research we focus only on the challenges tax reform raises for the management of the national debt.

I. Personalities: Who will be in the room when the sausage is made?

The personalities, all Republicans, who will drive this debate are going to have some interesting discussions to say the least, given their views on the appropriate size of government, the national debt and tax reform are widely divergent.

Let’s start with Speaker of the House Paul Ryan (Republican from Wisconsin), since tax legislation is mandated by the U.S. Constitution to originate in the House of Representatives. Tax reform is Speaker Ryan’s number one priority. The Ryan plan involves a large net tax decrease for individuals and corporations. Over time, whether government revenues start to increase depends on whether the economy grows at a much faster pace than currently. We can expect proponents of the Ryan tax plan to use some highly optimistic real GDP forecasts to justify the tax cuts. This was the strategy employed effectively in the 1980s by President Ronald Reagan, who embraced supply-side economics as made popular by Professor Art Laffer. Professor Laffer argued then (and now) that lower marginal tax rates can have a profound impact on raising economic growth leading to much higher tax revenues and lower budget deficits. The intuition is extremely appealing; however, the Reagan years did not work out that way. The national debt, which was only 31% of nominal GDP in Q4/1981 at the end of the first year of the Ronald Reagan Presidency, exploded to over 51% of GDP in Q4/1989 at the end of the first year of President George H. W. Bush’s Presidency. Despite the lack of empirical evidence, we are expecting some optimistic real GDP forecasts to accompany the Ryan tax cut plan so the tax plan will eventually pay for itself.

Paul Ryan’s compatriot inside the Cabinet will be the incoming U.S. Secretary of the Treasury Steven Mnuchin. Steven Mnuchin is a former Goldman Sachs partner, who later specialized in buying up distressed mortgages as a hedge fund manager before moving into the business of financing Hollywood movies. Mnuchin is focused on tax simplification and large corporate tax reductions. He is a strong believer that tax reform can significantly stimulate economic activity—upwards of 4% annual growth in real GDP. Gary Cohn, another former Goldman Sachs partner, will play a big role in the tax planning as the President’s Economic Advisor.

Next, let’s visit with Senate Majority Leader Mitch McConnell (Republican from Kentucky). Tax legislation may originate in the House of Representatives, yet eventually it has to pass in the Senate, too, and the mood in the Senate may not mirror that in the House. At a news conference on December 12, 2016, Mitch McConnell offered the following views: “I think this level of national debt is dangerous and unacceptable . . . My preference on tax reform is that it be revenue neutral.” (Source: Bloomberg News: https://www.bloomberg.com/politics/articles/2016-12-12/mcconnell-warning-of-dangerous-debt-wants-tax-cut-offsets)

Support in the Cabinet for a revenue neutral tax plan may come from the Director of the Office of Management and Budget (OMB). In the President-Elect’s press conference on December 19, 2016, naming Mick Mulvaney as his choice for OMB Director, Donald Trump had this to say: “We are going to do great things for the American people with Mick Mulvaney leading the Office of Management and Budget . . . Right now we are nearly $20 trillion in debt, but Mick is a very high-energy leader with deep convictions for how to responsibly manage our nation’s finances and save our country from drowning in red ink.” This is a pretty clear statement that restraining increases in the national debt is a key Republican Administration priority, and it makes it worth delving a little bit into the background of the new Director of OMB.

Mick Mulvaney was elected to the U.S. House of Representatives in 2010 as a Republican from the state of South Carolina. He helped co-found the Freedom Caucus, which steadfastly opposed increases in the national debt, and he helped lead the charge to remove former Speaker Boehner from the Office of Speaker of the House. Indeed, Mick Mulvaney has a perfect record of never voting for an increase in the national debt, opposing every measure to raise the debt ceiling since he joined Congress—even if it meant shutting down the government.

II. Reality Check: Current Federal Government Finances

The job of peacemaker in this most interesting budget debate is likely to fall to Donald Trump. And the outcome of whether to go with a revenue neutral tax plan (Senate, OMB) or a large tax cut (House, Treasury Department) is not at all clear. The problem is the reality of the current finances of the federal government, which we will now review.

The U.S. federal government debt outstanding as of the end of the Q3/2016 was $19.6 trillion compared to a national economy of $18.7 trillion. That is a national debt of 106% nominal GDP.

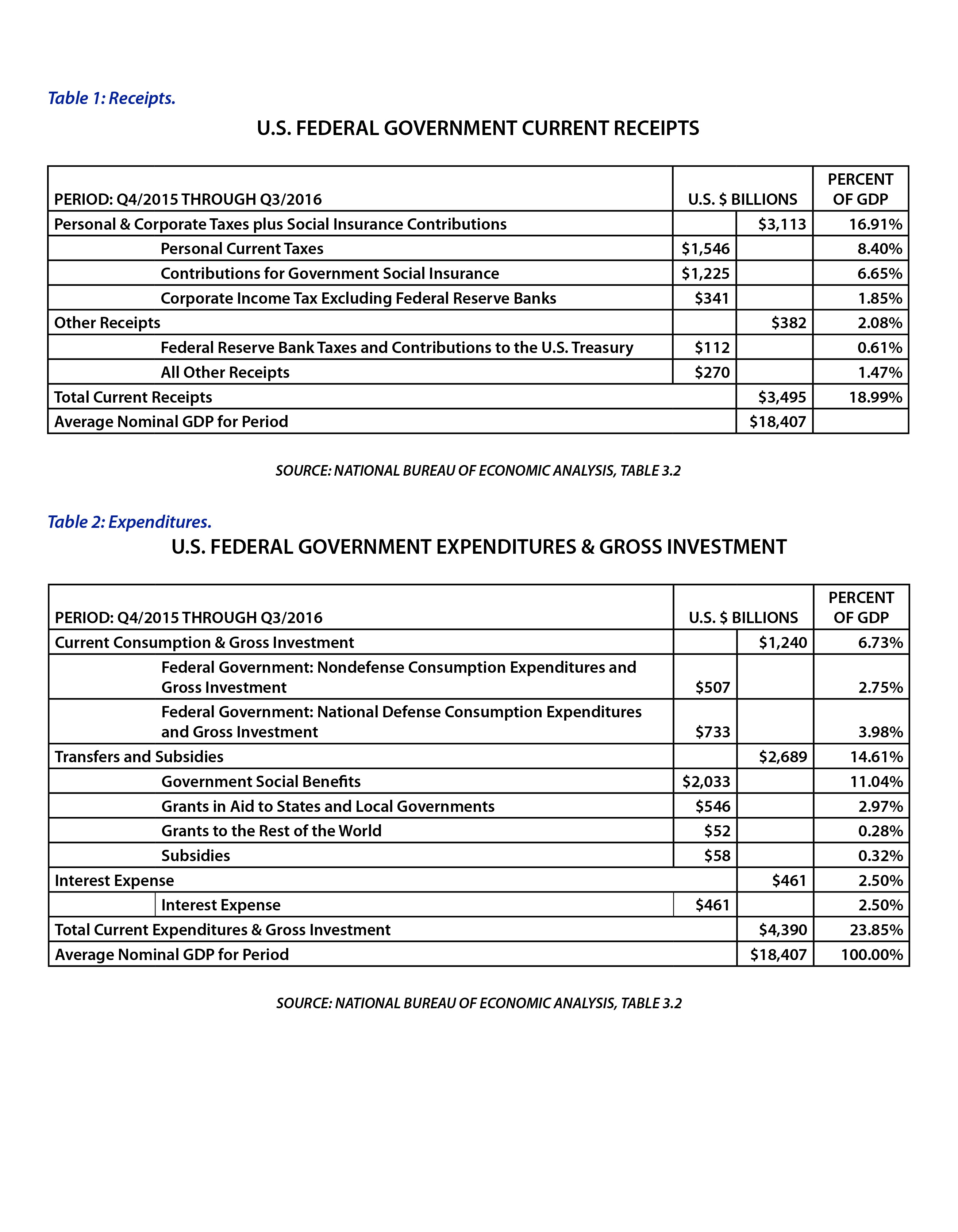

The federal government budget deficit for the period Q4/2015 through Q3/2016 was $629 billion or 3.4% of GDP. The budget balance involves current expenditures (less gross investment) of $4.124 trillion (22.4% of GDP) compared to the current receipts of $3.495 trillion (19.0% of GDP).

Unfortunately, the latest data underestimates the budget challenges facing the Republican Administration. There are two items in the budget that are near certainties to work in the direction of raising the deficit and the national debt, and they are both largely out of the control of the White House and Congress.

First, interest expense on the national debt has been held down by the low levels of interest rates since the financial panic of September 2008 led to the Great Recession. Interest expense in the past twelve months (Q4/2015 – Q3/2016) was $461 billion or 2.5% of GDP. As interest rates go up, so will interest expense. By 2020, making the heroic assumption of no increase in the national debt, we see interest expense heading north of $625 billion, and it could go much higher with rises in the national debt or higher than expected interest rates.

Then, there is the little watched item of corporate taxes on Federal Reserve Banks which includes the contributions of the Federal Reserve to the U.S. Treasury from its portfolio earnings. For the past twelve months (Q4/2015 – Q3/2016), the Federal Reserve assisted in reducing the deficit by $112 billion or 0.6% of GDP. This number is going to shrink rapidly as rising interest rates dramatically reduce Federal Reserve earnings on its portfolio. By 2020, Federal Reserve Banks may only be contributing $20-30 billion to the U.S. Treasury and possibly much less if interest rates go higher than expected.

So, before even thinking about tax cuts or spending increases, there is approximately a future $250 billion hole to fill as a result of rising interest expense and reduced Federal Reserve contributions that kicks in over the next four years. This means even before considering the likelihood of a more expansionary fiscal policy, we are looking at a national debt level of around $20.4 at the end of 2017, which implies one of the first acts of the new Republican Administration will be to deal with the debt ceiling.

III. What to do about the debt ceiling?

How to deal with the debt ceiling is likely to be contentious even among Republicans, and Congressional action will be needed sometime in the second quarter of 2017. The debt ceiling was temporarily suspended in late 2015 to avoid any Congressional vote during the 2016 election year, but it comes back as a political factor in 2017.

The debt ceiling will be reactivated at $20.1 trillion on March 16, 2017. The call to action on this challenge underscores the fact that when the law snaps back into effect, the United States is likely to be close to exceeding the limit. In short, while emergency measures can delay the onset of the debt ceiling for several months, there will not be any way to avoid dealing with this issue by the summer of 2017.

How the debt ceiling challenge is tackled will have serious ramifications in the equity and bond markets, where options implied volatility has been rising for bonds and falling for equities. The bond market is preparing for massive new issuance of government debt, which added to the allure of equities in an era of expected lower corporate taxes and lighter-touch regulation.

A little historical background may be useful. The debt ceiling goes back to 1917 when the law was enacted to make it easier to finance World War I by replacing the need for Congress to authorize each and every issuance of U.S. government debt. The debt ceiling puts a hard limit on the amount of money the U.S. government can borrow. Thus, there is the need for Congress to raise that limit when more than the allowed amount of money has been spent. It is noteworthy the debt ceiling created the potential inconsistency that Congress could pass spending laws and then not vote to give the U.S. Treasury authority to raise the money to fund the spending already legislated and planned, forcing a potential default or government shutdown.

Once upon a time, this inconsistency was resolved by the “Gephardt Rule”—named for former Senate Majority Leader Richard Gephardt (Democrat from Missouri)—which automatically raised the debt ceiling as soon as Congress passed a new budget for the coming fiscal year. The Gephardt Rule meant lawmakers did not have to cast a direct vote to raise the debt ceiling. This procedure was, however, repealed by Republicans in 1995 when they took over control of the House of Representatives. Since 1995, especially when the Republicans have controlled the House of Representatives, there have been several contentious battles over raising the debt ceiling, including some disruptive, albeit temporary, government shutdowns.

There is a possibility the usual rancor over raising the debt ceiling could be a thing of the past now that Republicans control the executive and legislative branches of government. However, as we noted in the “personality” discussion earlier, the rub might lie in the fact the Republican Party is not a monolithic entity when it comes to policy positions on fiscal discipline, with some of its elected representatives consistently voting against raising the debt ceiling to reflect the conservative aspirations of their constituencies. That thread of conservatism was perhaps most evident in the rural populism at the core of the Republican victory in the November election and embeds a strong theme of smaller government. This means navigating the debt ceiling may be the first real challenge of the Republican-led Congress.

Remember, too, the Democrats had to fight intense battles that eventually led to begrudging compromises with the Republicans over raising the debt ceiling. It is more than likely the Democratic strategy this time around would be to make the Republicans “own” any decision they make to raise the debt ceiling.

For their part, the Republicans will need to confront the implications of the spending plans and tax cuts of the new administration. There have been reports of significant infrastructure spending plans. From our perspective, the debate on tax reform will come first and define the debt ceiling debate. Infrastructure spending plans appear less of an “urgent” priority, and the infrastructure spending may well be spread over a number of years and possibly involve some collaboration with the private sector. Thus, the tax cut plans are set to collide with the need to raise the debt ceiling.

There are several possibilities. One interesting scenario is to abolish the debt ceiling—not all that likely yet not dissimilar to the Gephardt Rule of the past which automatically raised the debt ceiling when a budget was passed. If debt ceiling legislation focuses, as now, on a strict dollar limitation, it will have to be raised significantly due to the higher budget deficits coming—even if tax reform is revenue neutral. Or the Republican Congress could set the debt ceiling, say, at 110% of nominal GDP, potentially taking the issue off the table for the next four years, barring a recession.

How the debt ceiling is resolved has large implications for tax reform, as well as for equity and bond markets. The post-election equity rally and Treasury bond sell-off were based on expectations of a highly expansionary fiscal policy even as monetary policy turns less accommodative. If fiscal policy is less stimulative than expected, and especially if the anticipated size of personal and corporate tax cuts disappoint market participants, then equities could be challenged.

IV. Scenarios for tax reform, economic growth and the national debt

To analyze how debate over tax reform and national debt might develop, we will work through two scenarios focused mainly on the embedded assumption of real GDP growth. First, however, let’s review the starting point in terms of federal government finances as summarized in Tables 1 (Receipts) and 2 (Expenditures) so we appreciate the difficulty of the challenges at hand.

The scope for tax reform is probably limited to a combined tax cut of around 1.5% to 1.75% of nominal GDP. While we expect a vigorous internal Republican debate on whether tax reform should be revenue neutral, we think that scenario is not very likely. Nevertheless, the nature of the debate could result in smaller net tax cuts.

To conduct our experiments and develop two scenarios, we made some simplifying assumptions about inflation and government expenditure growth. In particular, all our cases assume inflation gradually approaches 3.5% and then stabilizes. And, we make the heroic assumption that the Republican Administration can hold government expenditures to a growth rate in line with inflation. These assumptions have the practical implications of framing the issue in terms of the size of the tax cut and the growth rate of real GDP. That is, as noted in our introductory section, we are going to focus on tax reform. We think this is a very high priority of the new Administration, coming well ahead of any new spending plans.

Our first scenario is tax reform reduces total government receipts to an average of 17.25% of GDP by 2020, and real GDP responds by growing at an average of 3.5% per year over 2018-2020. This scenario embeds a very big net tax cut of around 1.6% of GDP.

If the Republican Administration can hold the growth in government discretionary spending in line with expected inflation and the 3.5% average annual real GDP growth comes to pass (without an intervening recession), then by Q4/2024 the budget could be virtually in balance and the national debt might be as low as 75% of GDP.

This scenario still implies a total national debt of just under $24 trillion by end of 2020 and $25.5 trillion end of 2024. So, the debt ceiling would need to be materially raised from its $20 trillion level of March 2017. Nevertheless, the reduction in the national debt as a percent of GDP from over 100% now to around 75% would be very impressive, as would achieving a balanced budget by 2024. Only Presidents Carter and Clinton came close to budget balance in the final year of their Administrations. Unfortunately, if real GDP does not grow at 3.5% per year for the whole of 2018-2024 without an intervening recession, the outcome will not be nearly so comforting.

In a less rosy scenario, taxes are cut and total government receipts are still reduced to an average of 17.25% of GDP by 2020 as in the previous scenario; however, real GDP grows only by an average of 2.25% per year over 2018-2024. This real GDP growth rate would be a small improvement over the 2010-2016 average annual real GDP growth rate of 2.1%. Both of these scenarios mean the current economic expansion, already a long one by any standard, sets all-time records for longevity.

In this moderate growth scenario, national debt reaches $23 trillion by end of 2020, and $26.5 trillion by end 2024. This would still represent an improvement in the debt to GDP ratio down to 90%. As before, though, both scenarios embed the heroic view that spending grows in line with inflation—no real (inflation-adjusted) growth in government expenditures. This is not very likely—emphasizing these scenarios are actually quite optimistic starting points for analysis.

V. Market Reactions?

When we study the analysis summarized above, we come to the conclusion there is a reasonable probability tax cuts may be phased in or staged in such a way as to delay the impact on the budget deficit and national debt. That is, any debt ceiling compromise among the different factions within the Republican Party could very well roil both equity and bond markets. Equities had a very strong rally after the November elections, while bond yields rose sharply. And, equity volatility declined to very low levels while bond volatility increased. The market reactions are sustainable in the scenario that involves (a) a big tax cut, (b) strong and sustained economic growth with no intervening recession and (c) very strong discipline on federal government spending. If one cannot handle these assumptions, one may want to consider the scenario in which equities may have a much more challenging year with more volatility than Q4/2016 activity suggested, and in these circumstances, the utility of options as a risk management tool comes to the fore.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.