January 2014

Many traders think in terms of buying (selling) interest rate futures to capitalize on anticipated falling (rising) yields in response to changes in Fed policy or to dynamic macroeconomic conditions. Some take a more subtle approach by trading spreads between, for example, CBOT Treasury futures to capitalize on changes in the shape of the yield curve.

But until the introduction of CBOT Deliverable Swap Futures (DSFs), it was difficult to construct a credit spread using interest rate futures contracts. This article examines the “swap spread” reflecting the spread between interest rate swap and Treasury rates with the use of DSFs and CBOT Treasury futures.

ABOUT DSFS

DSFs were introduced in December 2012 and call for the delivery of an over-the-counter (OTC) interest rate swap (IRS) through the facilities of the CME Clearing House. These delivered swaps are structured using standardized or plain-vanilla terms and conditions. Separate contracts are listed that call for the delivery of 2-, 5-, 10- or 30-year term swaps with a notional value of $100,000. Contracts carry a fixed coupon rate that approximates current market rates, e.g., 0.5%, 1.0%, 1.5%, 2.0%, etc.DSFs are listed with quarterly expirations on the Monday preceding the 3rd Wednesday of the contract months of March, June, September and December. They are quoted as 100% of par plus the Non-Par Value (NPV) of the swap to-be-delivered, in percent of par. The NPV of a swap may be positive or negative contingent upon the relationship between prevailing swap rates and the fixed coupon rate. Thus, like a T-note or T-bond, they are quoted as either above or below 100% of par, e.g., 101%, 98%, etc.

Like the familiar Treasury futures, they are quoted in percent of par with ticks at a fraction of 1% of the $100,000 face value, e.g., the 10-year DSF tick equals ½ of 1/32nd or $15.625. Upon delivery, the buyer (long) of a DSF contract becomes the fixed rate receiver (floating rate payer) of the delivered swap. The seller (short) becomes the fixed rate payer (floating rate receiver). The delivered swap is based upon a floating 3-month LIBOR rate vs. the fixed coupon rate. Participation in the delivery process is restricted to “Eligible Contract Participants,” generally including institutions. But the average player may nonetheless trade DSFs freely provided they liquidate before becoming involved in a delivery.

CREDIT SPREADS

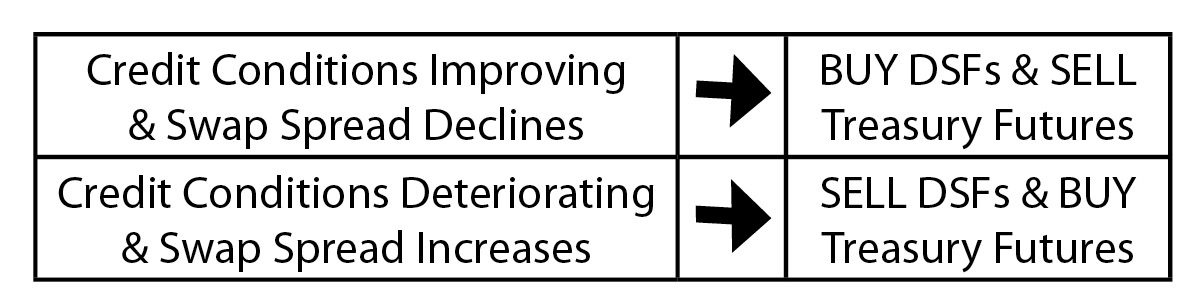

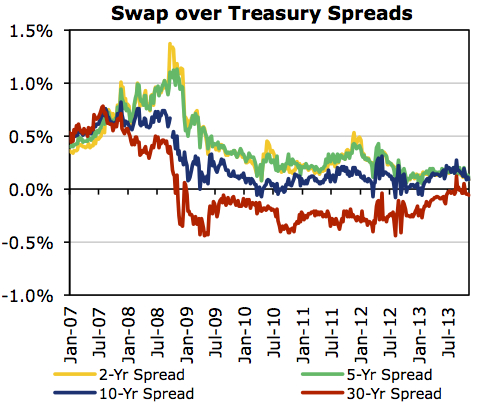

Private credit risks are represented in LIBOR rates while public credit risks are represented in U.S. Treasuries. When credit conditions deteriorate, private rates tend to increase relative to public rates. Swap spreads, quoted as the swap rate minus the rate associated with a Treasury security of comparable maturity, increases. This is generally what occurred in the wake of the subprime crisis in 2008. But when credit conditions improve, private rates tend to decline relative to public rates and the spread tends to fall. Thus swap spreads generally declined to more normal levels as the U.S. economy slowly recovered from the crisis. You can take advantage of expectations regarding credit conditions by trading a spread between DSFs (reflecting private risks) vs. Treasury futures (reflecting public risks). Buy Treasury futures and sell DSFs in anticipation of credit episodes and widening spreads. Sell Treasury futures and buy DSFs in anticipation of improving credit quality and narrowing spreads.

Normally we expect private borrowing rates to be above public rates. But this assumption has not always held true. The 30-year swap spread fell to negative levels subsequent to the sub-prime crisis and is only now returning to a more normal level. Why did this happen?

• “Too Big to Fail” – The Fed backstopped the banking industry during the subprime crisis while S&P downgraded the credit rating of U.S. long-term sovereign debt in August 2011. Thus, private and public credit risks implicitly converged.

• IRS Structure – When you purchase Treasury securities, you generally pay cash. But IRS instruments may be traded with no up-front payment between the counterparties. This reduces credit risk of swaps relative to Treasuries.

• LDI Movement – Pension funds, insurance companies and others with long-term liabilities have embraced “liability-driven investment” or LDI. This strategy calls for investment managers to match the term of investments with the term of liabilities. Many now rely on very long-term swaps instead of long-term Treasuries, pushing the 30-year swap spread to negative levels.

STRUCTURING THE SPREAD

Assume you believe that credit conditions deteriorate and the 10-year swap spread may advance. This suggests that you buy 10-year Treasury note futures and sell 10-year DSFs. But how to structure the spread so that it is only sensitive to changes in the yields underlying the contracts and not to other factors?

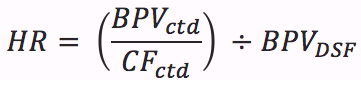

This is accomplished by weighting the spread in a ratio driven by the relative volatility of 10-year T-note futures vs. 10-year DSFs using a “hedge ratio” as follows.

Where BPV = basis point value or the expected dollar change in value given a 0.01% or 1 basis point change in yield; CF = conversion factor of the security for delivery into futures; and, CTD = cheapest-to-deliver security into futures.

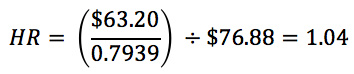

E.g., as of November 22, 2013, the 2-1/8% note of 2020 was cheapest to deliver vs. the December 2013 10-year T-note with a CF=0.7939 and a BPV=$63.20 per $100,000 face value. The BPV of the December 2013 10-year DSF was $76.88.

The hedge ratio is calculated as 1.04, suggesting that one may trade the spread on a 1-for-1 basis. i.e., buy one (1) 10-year T-note futures vs. the sale of one (1) 10-year DSF. On a larger scale, buy twenty (20) 10-year T-note futures vs. the sale of twenty-one (21) 10-year DSFs.

RESOURCES

To view regularly updated charts which highlight the different versions of Swap Spreads for the 4 tenors of CME Group’s DSFs –all in rate terms, visit www.cmegroup.com/swapspreads

To learn more about the full suite of CME Group Interest Rate products, visit www.cmegroup.com/interestrates

Copyright 2013 CME Group All Rights Reserved. Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade. All examples in this brochure are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience.

Swaps trading is not suitable for all investors, involves the risk of loss and should only be undertaken by investors who are ECPs within the meaning of Section 1(a)18 of the Commodity Exchange Act. Swaps are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade.

CME Group is a trademark of CME Group Inc. The Globe logo, E-mini, Globex, CME and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. Chicago Board of Trade is a trademark of the Board of Trade of the City of Chicago, Inc. NYMEX is a trademark of the New York Mercantile Exchange, Inc.

The information within this document has been compiled by CME Group for general purposes only and has not taken into account the specific situations of any recipients of the information. CME Group assumes no responsibility for any errors or omissions. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, CBOT and NYMEX rules. Current CME/CBOT/NYMEX rules should be consulted in all cases before taking any action.