May 2014

Traders are professional risk-takers. But what about your personal wealth?

Every trading professional knows that market risk must be clearly understood and expertly managed if you want to survive, let alone strengthen your human capital as a trader. But how do the vital concepts of risk and reward apply to your financial capital – i.e., the proceeds you keep for your and your family’s personal wealth and well-being?

The risk itself doesn’t change. But – and this is key – how you manage market risks in your personal life versus your professional career is a whole different game. This is true for all investors, but it’s especially important for professional traders and others whose careers hinge on high-risk ventures. In this article, we’ll explain strategic differences as well as practical applications for managing market risks in your personal investment portfolio.

SHIFTING YOUR INVESTMENT MINDSET

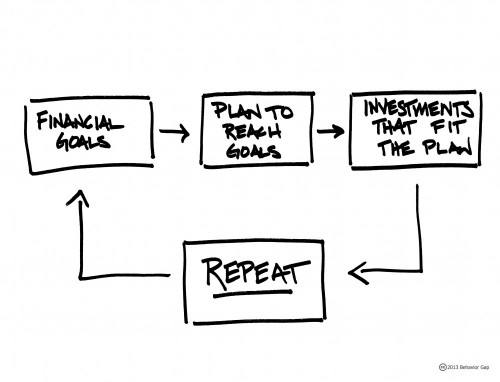

It takes at least two shifts to build a portfolio for your personal wealth that appropriately complements your high-risk day job as a professional trader: One is in your own attitude. The other is in the way you take on market risk.

Shift your attitudes. The first step in managing your personal portfolio is to think of it as a bastion for offsetting some of the high market risks you are taking in your career. That’s why the concepts that drive sound risk management for your investments are different from those that drive the risk-taking you embrace in your career.

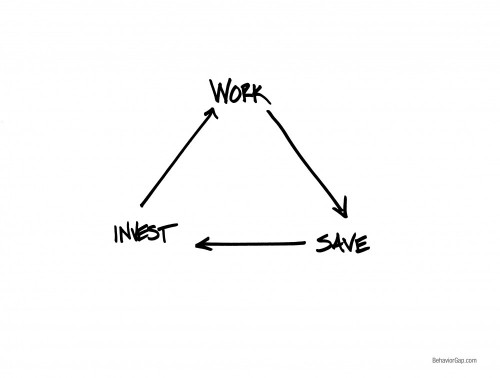

Your career is for earning the wealth to begin with. When you invest that wealth, you do so to maintain your desired lifestyle as well as to sustain you and your family through challenging periods, such as when your trading activities may underwhelm or you are in a career transition. You want to manage your portfolio in proper measure for two very different roles: accumulation and preservation.

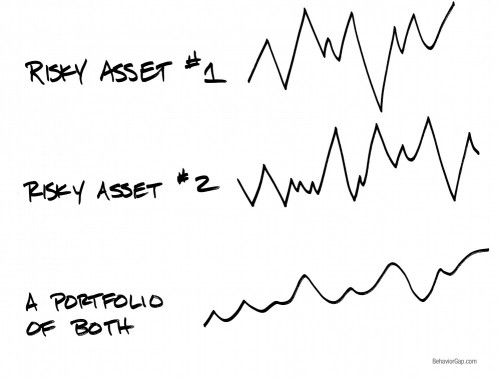

Shift your risks. Here’s a concept that is powerful, and yet unfamiliar to most investors: By adopting less equity risk in your personal portfolio, but heavily tilting that risk toward a globally diversified small-cap and value concentration, you can still capture appropriate levels of expected long-term investment returns while putting a damper on the risk involved.

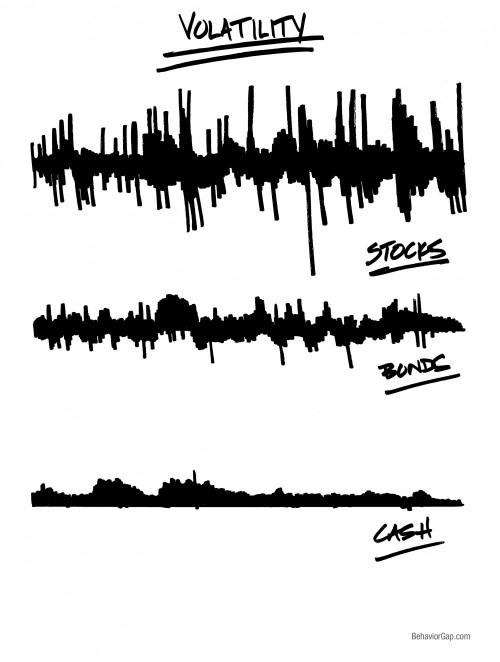

The “risks involved” include both volatility and shortfall risks. Most are familiar with market volatility risk, i.e., the amount security prices fluctuate in the short-term, along the way to their long-term outcomes. Shortfall is the risk that an investment will eventually deliver its expected premium, but in worst-case scenarios, not soon enough for the individual investor to benefit from it.

The notion is to manage market risk by taking on less overall equity risk – but more risk exposure within the equities that you do take on. This is an intriguing possibility for trading professionals who seek a comfortable balance between carefully preserving the bulk of their hard-won personal wealth, while remaining open to some level of continued growth.

Our end goal is to show you how you can take necessary market risk in your personal trading portfolio while strengthening your ability to survive various downturns and financial turmoil – in your life as well as in your career.

MY OWN LIFE LESSONS ABOUT RISK AND REWARD

When I began my former career as a trader more than 20 years ago, I received two great pieces of advice. The first one came from a great and charismatic trader who went by “TEX” (yes, in all-caps). One day early on, TEX watched as I put on a trade that became immediately profitable. And then very profitable.

“Nice win,” said TEX.

“Thanks,” I replied. “I think I’ll let it run.”

“A big part of trading success,” cautioned TEX, “is knowing when to exit and keep some winnings that they cannot take back.”

TEX’s advice was spot on. He taught me not only the difference between being right and being greedy, but also that the trader’s job is to build wealth, not just be correct in a trade. By taking some of a winning trade off the table, you’ve locked in at least a portion of the profits, safeguarding your ability, and your assets, to fight another day.

Over the years, I often saw traders creating great, rapid wealth. They did so by becoming adept at taking on high risk to achieve high fortunes. But then, all too often, they’d ignore TEX’s advice. They’d take all of the winnings and plow them straight into the next highly concentrated, often leveraged investment. That worked well every time… right up until the time that it didn’t. Then, they’d start all over, if they were able.

It is easy to spot the lessons here that apply not only to trading but to your personal wealth, where “starting all over” can be even more painful – for you and your family. This brings me to a second critical piece of wealth-management advice I learned during my trading career.

Like many of my fellow traders in the late 1990s and into the early 2000s, I had earned a great living from taking repeated risks over time. I would pay myself to afford my lifestyle and obligations, while also extracting some portion of the winnings into a portfolio held away from my trading accounts and invested mostly in diversified, low-cost equity and high-quality muni bond index funds.

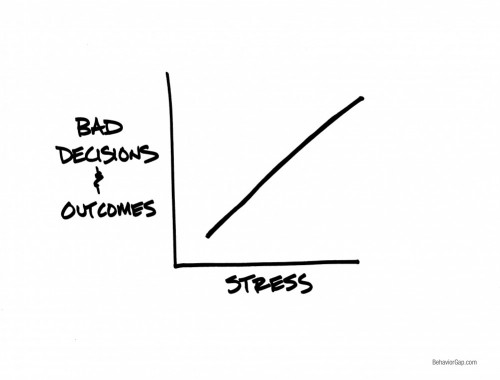

I thought I was doing okay with this strategy. And, in fact, it was a great start. But I was known to periodically stray. For example, I once got myself into a good bit of trouble chasing some high-yield bond funds that I could not resist, ignoring the reality that there is no such thing as a free ride when it comes to risk/reward tradeoffs, no matter what the asset class.

Then I met Greg, a game-changing trader and entrepreneur. Greg directed me along the final steps in my growth toward becoming a wealth manager by helping me cement my beliefs about what a proper personal portfolio for a highly leveraged trader should be: It should be very efficient, if not also BORING!

Greg recommended that I forget about increasing risk/reward levels in my personal portfolio and instead actually reduce my exposure to equity in favor of high-grade fixed income. At first, the advice sounded crazy to a young buck like me with a long investment horizon and a promising future in futures. But then he convinced me it was crazy like a fox. He reminded me that we trading professionals risk so much in our day trading, that we should insulate ourselves from the vagaries of risky markets in the personal side of our investments. That way, when the risk shows up in either our own trades or the economy and markets as a whole, we are able to come back and fight another day.

To broaden out this concept, BAM ALLIANCE Director of Research Larry Swedroe proposes that, the greater/weaker the stability of your earned income, the greater/weaker the ability to risk owning stocks. In his February 3, 2014 CBS MoneyWatch post, “Asset Allocation Guide, How much risk should you take?” Swedroe says:

“For example, a tenured professor has a greater ability to take risk than either a worker in a highly cyclical industry where layoffs are common or an entrepreneur owning a business with cyclical earnings. The tenured professor’s earned income has bond-like characteristics. All other things being equal, she has more ability to hold equity investments. The entrepreneur’s earned income has equity-like characteristics. He should hold more fixed income investments.”

According to Swedroe’s description, a trader’s labor capital has more in common with stocks than bonds. This is what Greg was getting at as well. Once I took his sensible advice to heart, I realized it echoed TEX’s wise counsel. Everything began to click into place … almost. These were excellent ideas to begin with. Over time, I’ve learned of ways to improve on them by enhancing expected investment outcomes without tearing holes in one’s safety net.

HOW TO THINK ABOUT EXPECTED RETURNS: A CLOSER LOOK

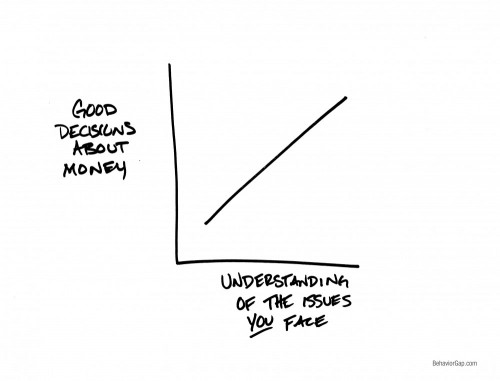

The first step in understanding managing market risks within your personal portfolio is to consider its components.

Underlying all equity asset classes is the concept of “Beta risk” or general equity risk, which is expected to generate returns above risk-free investments such as Treasuries. In other words, there is a certain amount of risk associated with investing in any sort of stocks. Beta is how we measure a security’s or portfolio’s risk relative to the market as a whole. A Beta of 1 indicates that the security’s price tends to move with the market. A Beta of less than 1 means that the security will tend to be less risky than the market. A Beta of greater than 1 indicates that the security’s price will tend to be more risky than the market.

Small-cap and Value equity asset classes expose investors to higher market risks, with commensurate expected higher returns beyond Beta. “Small” means companies with a relative smaller market cap, and value stocks are those that tend to trade at a lower price relative to measures such as book-to-market, earnings, or cash flow. These expected premiums are seen in the Center for Research in Security Prices (CRSP) index, developed by two University of Chicago professors Eugene Fama and Kenneth French in conjunction with their research on the small-and-value phenomenon. (Yes, the same Professor Fama who was a co-recipient of the 2013 Nobel Prize in Economics in recognition of his empirical analysis of asset prices.)

Combining Beta, small-cap and value factors, it’s possible to build the equity portion of your portfolio with a “bar bell” approach that allows you to lower your overall equity allocation, while still constructing for similar expected returns compared to a portfolio that holds more market-like stocks. This helps cut the tail risks, both good and bad. In other words, you sacrifice some of the potential for great returns, to minimize the risks of very poor returns.

It is worth noting that the precise reasons for the small-cap and value factors’ expected outperformance remain subject to debate. Professors Fama and French hypothesized that these premiums were explained by risk. And there is plenty of evidencing supporting that view, especially when it comes to the size and market premiums. However, when it comes to the value premium, there is plenty of evidence that the premium could be a result of behavioral errors (meaning that the market is persistently overvaluing growth stocks and undervaluing value stocks). My own view is that it is likely some of both. In other words, value stocks are riskier, but the risk premium seems too large to be explained by the extra risks.

For those who wish to dive more deeply into the strategies described here, Swedroe has a book forthcoming to explore portfolio construction in detail. Co-authored with the BAM ALLIANCE Director of Investment Analysis Kevin Grogan, its working title is “Reducing the Risk of Black Swans: Using the Science of Investing to Capture Returns with Less Volatility.”

CONSIDERING YOUR TIME HORIZON

Let’s return to my trading friend Greg’s wise advice about reducing exposure to equity in favor of high-grade fixed income to shore up your family wealth. How do you determine the right balance there?

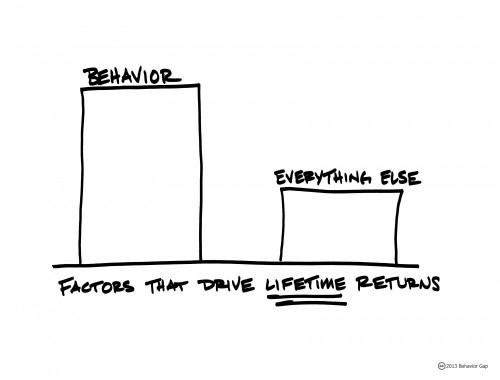

Applying the construction techniques described above can potentially help you reduce your equity exposure and increase your fixed income allocation. In addition, your ability to take on personal market risk is a tale of time. The longer your time horizon for investing, the better you are positioned to tolerate volatility and shortfall risks. This can help you consider higher exposures to equity. Of course you’ve still got to tolerate the risks when they do appear along the way! If you instead lose resolve and get out, you’ll lock in losses that would otherwise likely have been avoided by patiently riding them out.

TRACKING ERROR REGRET

As usual in investing, it seems there is always one more caveat to consider before we call it a wrap. In this case, we want to address Tracking Error Regret. The more a strategy strays from a beaten path, the less likely it is to behave like a popular benchmark. This is known as tracking error.

Because the make-up of a customized portfolio may only somewhat align with a common benchmark, there will likely be times when it significantly underperforms in comparison. By seeking to eke extra returns from the market for the level of risk exposure taken, you stray from what is considered “typical.” As such, you must be prepared to ignore the tracking error you are likely to encounter along the way. Otherwise, you might lose faith and bail out at precisely the worst time, selling low. Investors who are likely to succumb to tracking error regret may be better served by taking a more traditional approach, where tracking error is less severe.

THE RIGHT PORTFOLIO FOR YOU

Clearly, arriving at the right portfolio for you and your family’s personal wealth is a delicate balancing act. This is where a professional advisor can add considerable benefit, especially if he or she is: (1) well-versed in portfolio construction strategies as described, (2) deeply familiar with your personal circumstances so they can be taken into account, (3) employing Monte Carlo modeling and other tools to gauge a strategy’s appropriateness, and (4) able to recommend investment funds and solutions optimized to make the most of the portfolio strategy you devise.

I hope I’ve provided intriguing food for thought about separating your career risks, like your trading account assets, from your personal, family wealth. By applying the principles I learned early on from mentors such as TEX and Greg to myself and my trading industry clients, I strive to ensure that we in the trading community will not only live to fight another day, but that we’ll fully enjoy living it.

About the author:

Before founding The Cogent Advisor, an Illinois Registered Investment Advisor firm, Michael J. Evans was a veteran commodities trader on the Chicago Mercantile Exchange, executing trades and managing risk for more than 20 years. A client of Advantage Futures for many years, he owns a CME Group IMM exchange membership to this day. Currently, he provides wealth management services to a select number of successful financial trading professionals and other Chicago-area investors. A DePaul University alumnus, Evans earned a bachelor’s of science degree and a graduate certificate in financial planning from the College of Commerce. He presently serves on the DePaul University College of Commerce Finance Advisory Board and The Irish Fellowship Club of Chicago.